The IRS is moving toward

mandatory e-filing.

- The U.S. Treasury’s Executive Order 14247 is modernizing payments across federal systems, accelerating the shift to electronic tax filing and payments.

- Switch to e-filing for faster, safer, and smarter tax processing.

- E-file your Form 720 with QuickFile720 today.

Form 720 Online Vs Paper

| Factor | Online Filing | Manual Filing |

|---|---|---|

| Speed | File in minutes; faster processing by IRS | Takes longer for processing and manual submission |

| Accuracy | Automated checks reduce errors | Higher risk of human errors during data entry |

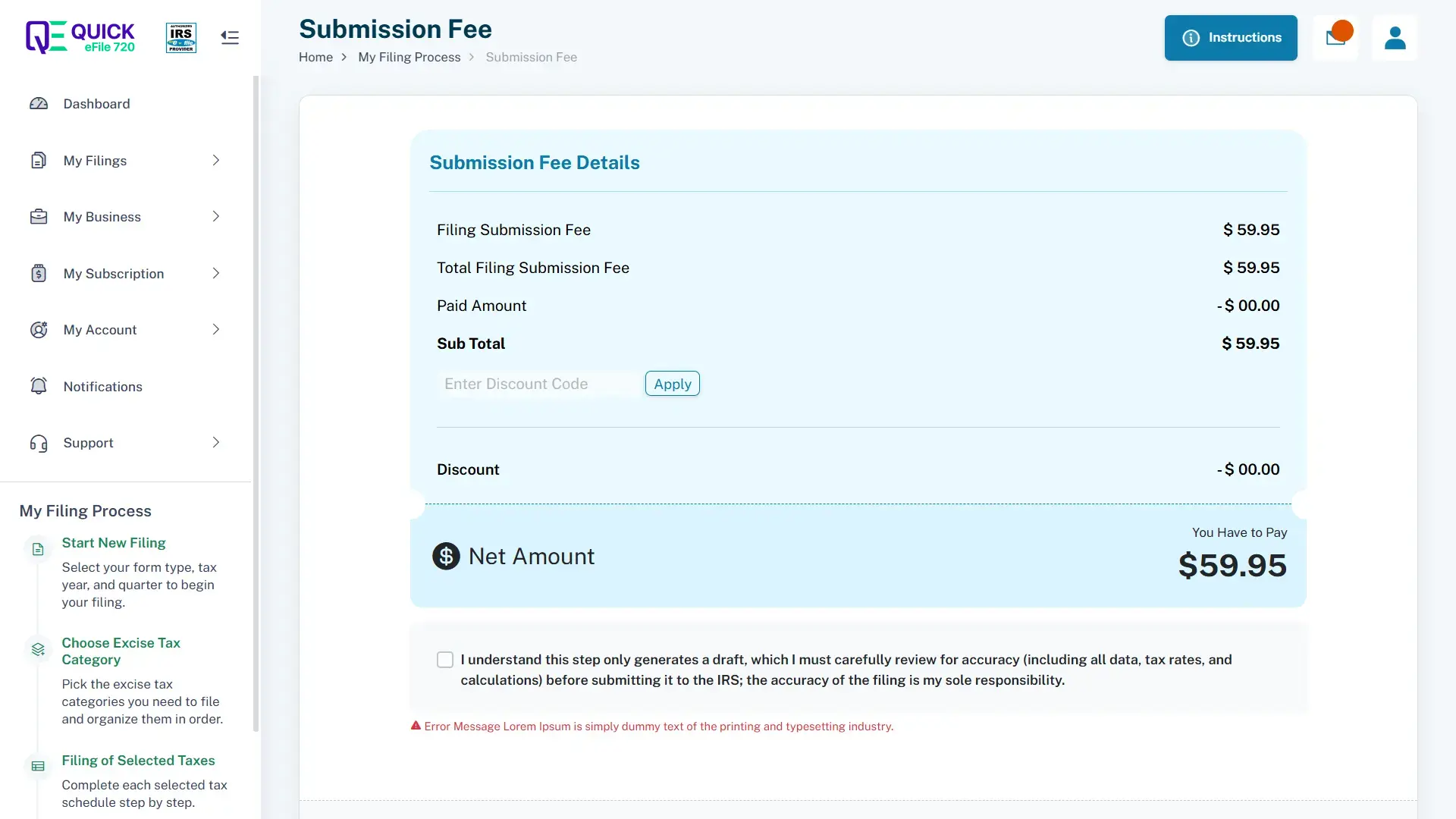

| Cost | Low Processing Fee (no postage fees, paper, etc.) | Additional cost for postage, paper, and handling |

| Efficiency | Streamlined process, easy form navigation | Slower process, requires physical effort |

| Storage | Digital storage; easy to access and secure | Physical storage required for paper forms |

| Maintenance | Easy to update; software handles form revisions | Requires re-filing and manual updates if mistakes occur |

| Acknowledgement | Immediate electronic confirmation from IRS | Delayed acknowledgment; depends on postal mail |

Why File Your Form 720 Online Using QuickFile720?

IRS-Authorized Portal

QuickFile720 is an IRS-authorized 720 platform, ensuring federal excise tax compliance with all IRS regulations. You can trust our secure system for accurate and timely filing.

AICPA SOC Certified Portal

Our portal meets AICPA SOC standards, guaranteeing high security and reliability. Your data is protected with industry-leading privacy and compliance measures.

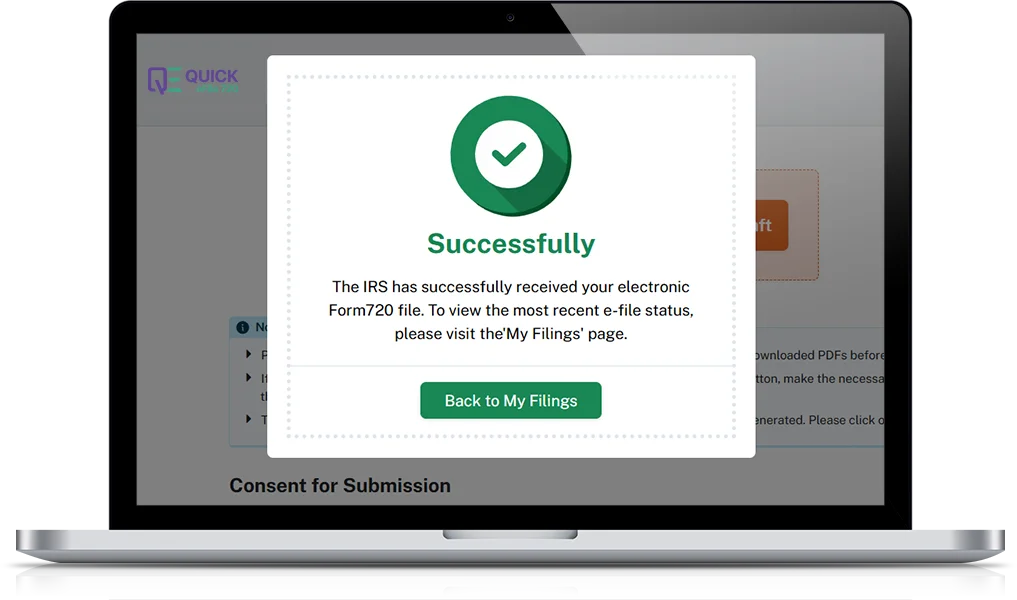

Instant Acknowledgement

Receive instant confirmation upon filing your Form 720 online. Get peace of mind knowing your submission has been successfully received by the IRS.

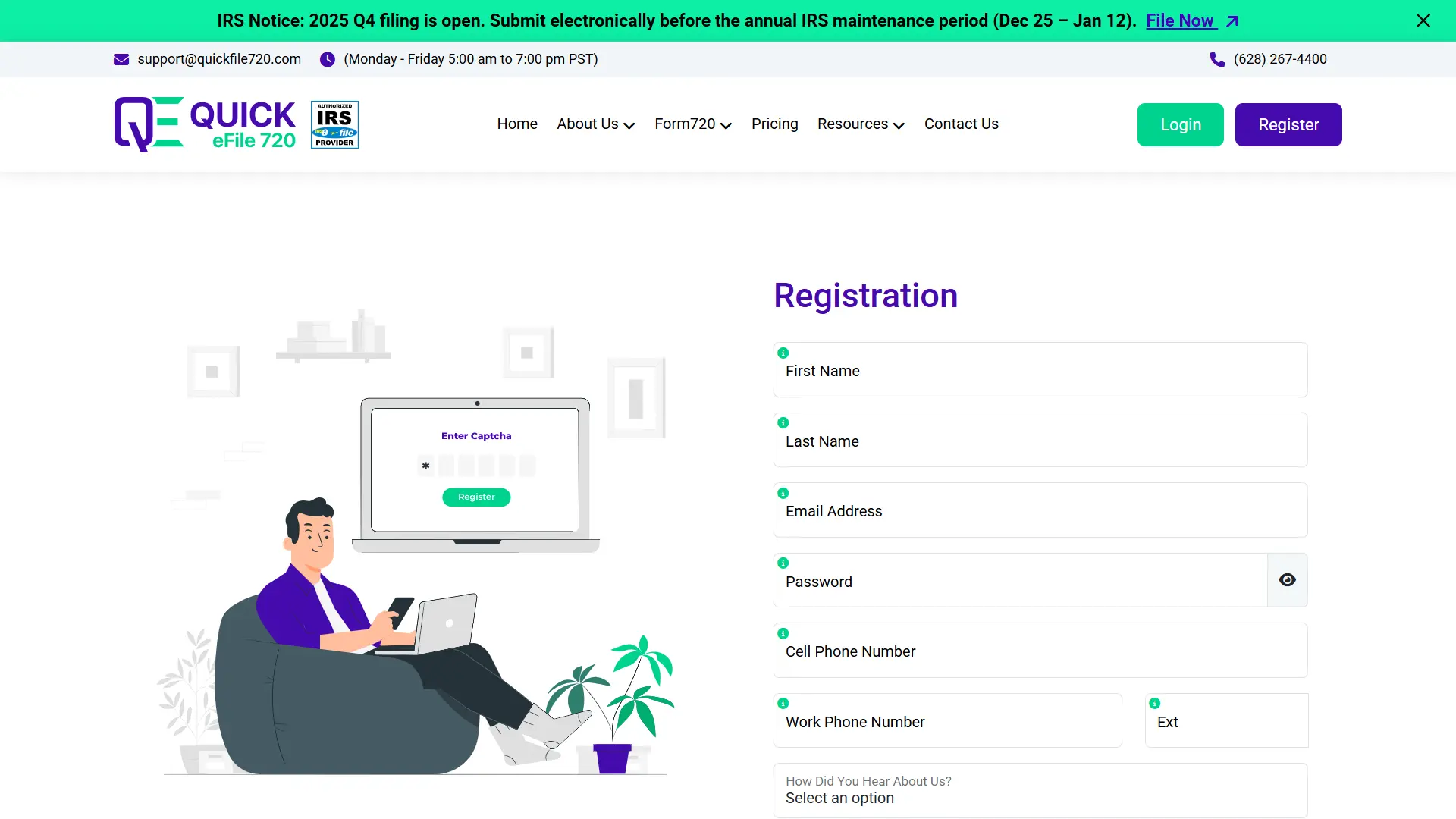

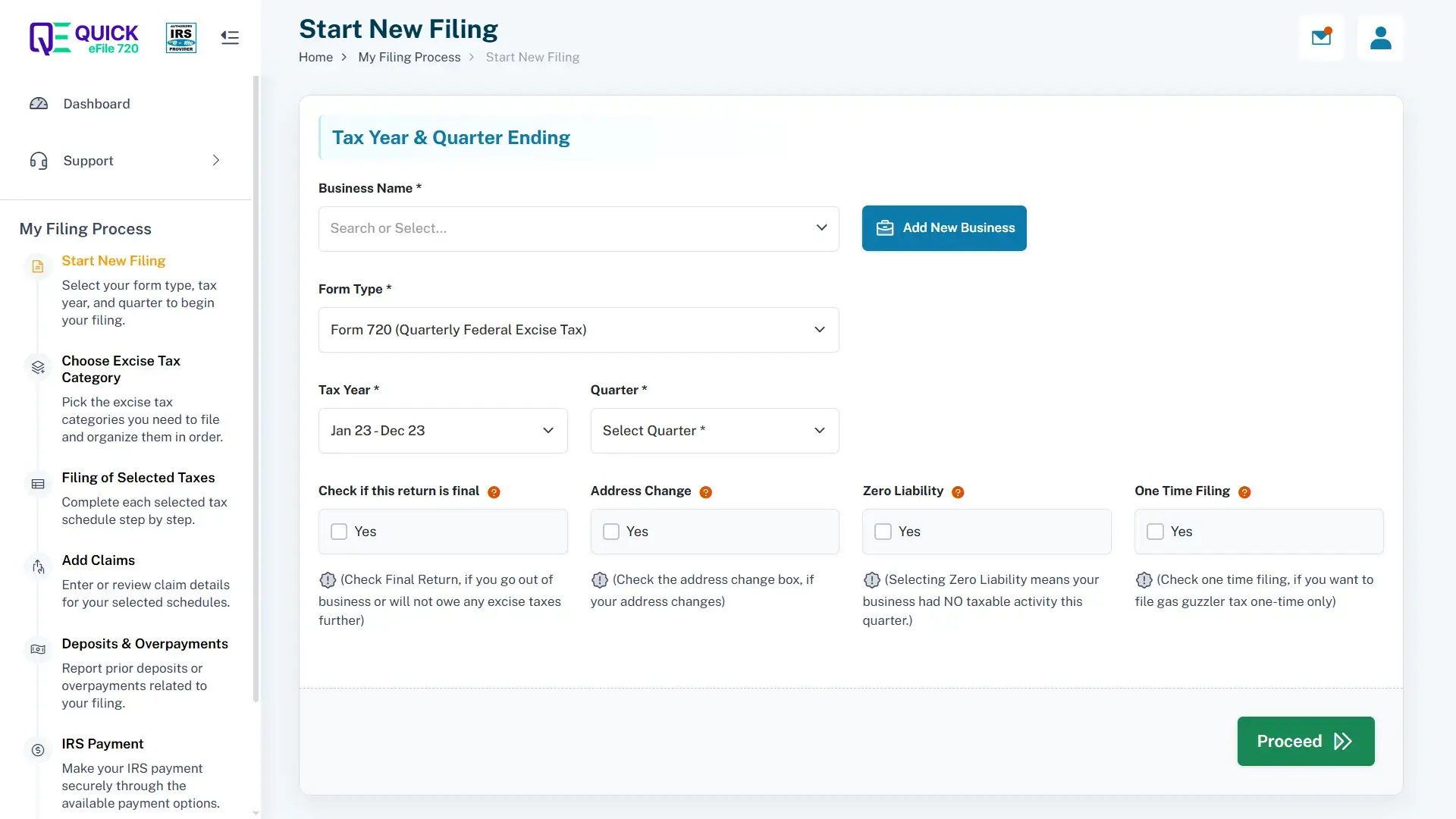

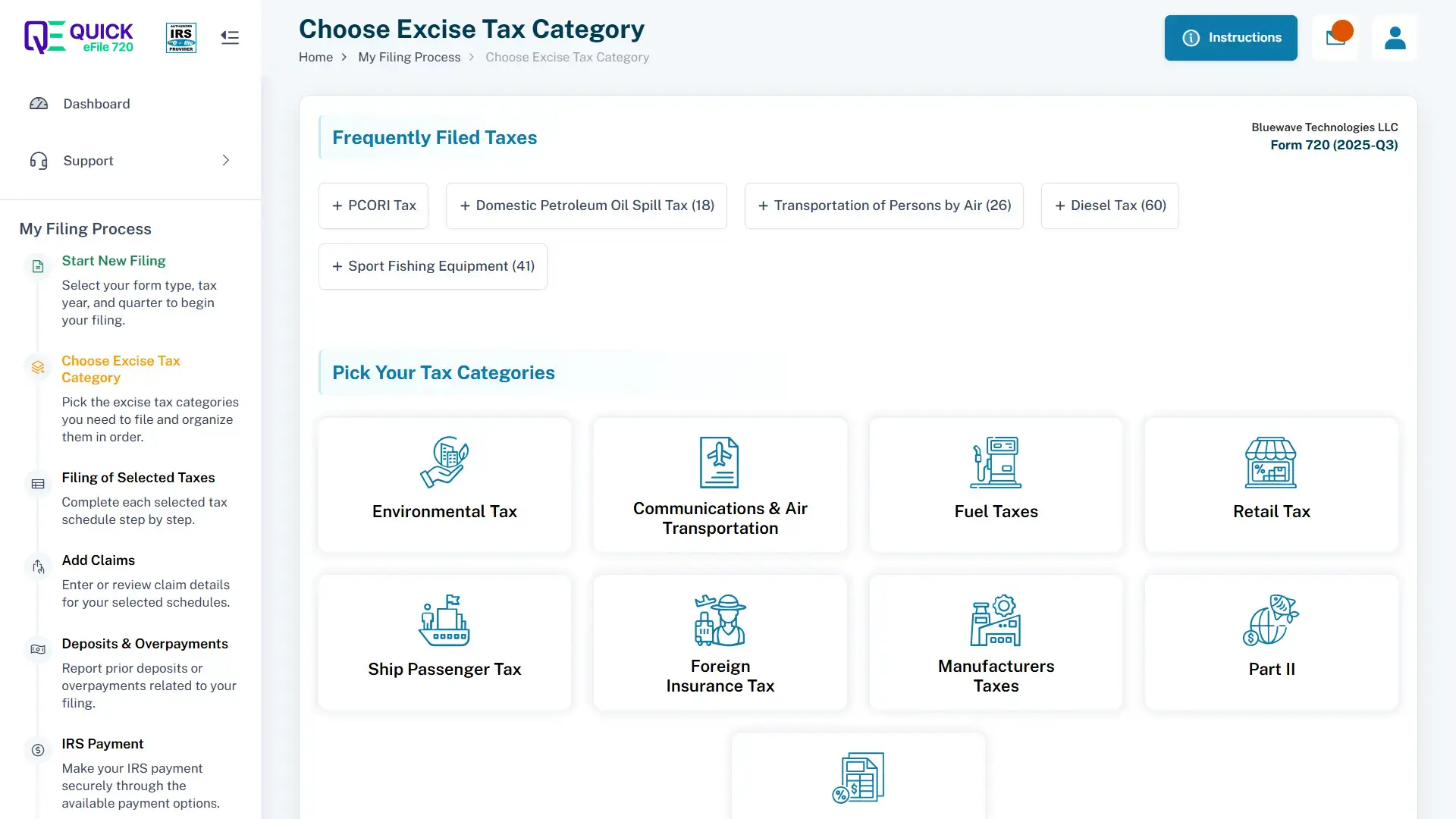

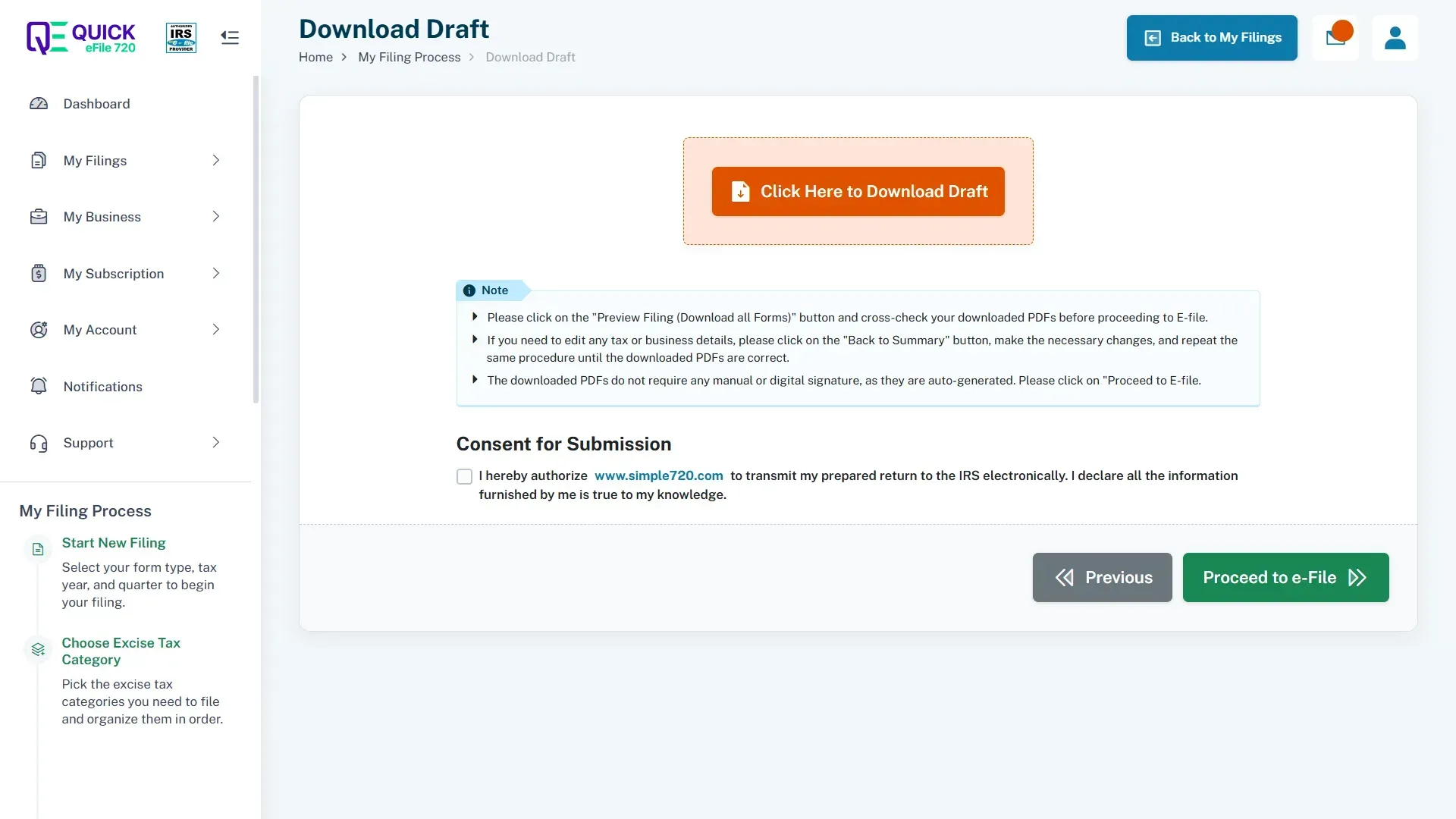

5 Simple Steps to Complete

Your Form 720 Filing with QuickFile720

Form

Category

Instantly

Happy Clients

Easy Navigation

QuickFile720 Online Portal made filing Form 720 a breeze! The platform is so user-friendly, and I was able to complete everything in just a few minutes.

Affordable Processing Fee

I appreciate the transparent, affordable processing fees. QuickFile720 provides excellent value for such a seamless experience.

Excellent Support

The support team was available 24/7 to assist with my questions. QuickFile720's customer service made the entire process stress-free!